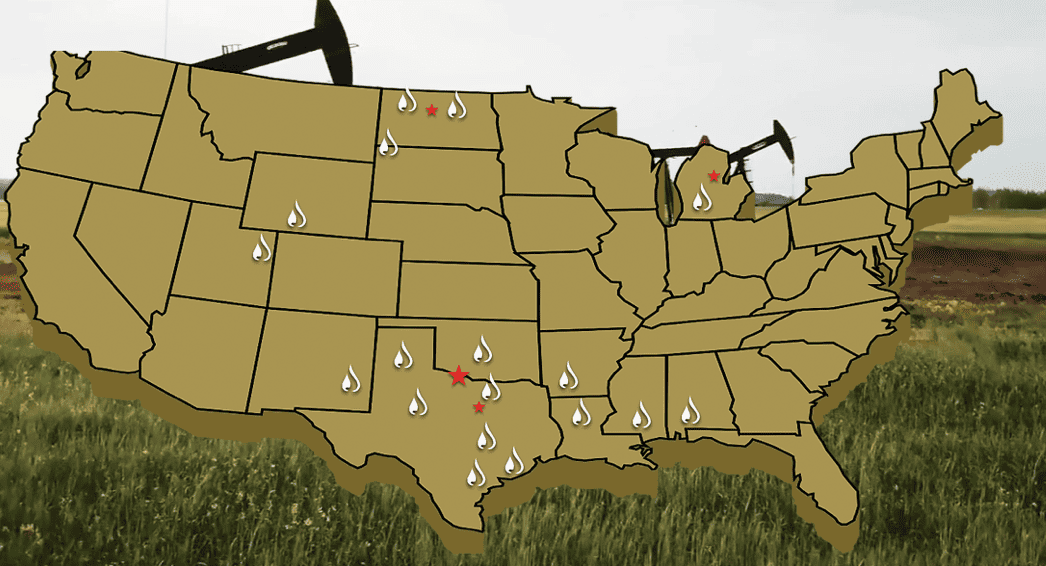

Oil and gas investments can be a lucrative way to diversify your portfolio and potentially earn significant returns. However, before diving into this complex world, it's important to have a basic understanding of how the industry works and the factors that affect investment returns. In this post, we'll provide an overview of oil and gas investing, including how companies operate and the various investment options available.

1. Oil and gas investments can be a lucrative way to diversify your portfolio and potentially earn significant returns.

2. It's important to have a basic understanding of how the industry works and the factors that affect investment returns before diving into this complex world.

3. Familiarizing oneself with the fundamentals, such as supply and demand dynamics, extraction methods, and market trends, can help investors make more informed decisions.

4. Staying updated on global geopolitical events and energy policies is essential as they can greatly impact the industry.

5. With the right knowledge and careful analysis, individuals can potentially capitalize on the opportunities presented by oil and gas investing.

Global oil consumption is predicted to reach 100 million barrels per day by 2021, reflecting a growing demand for oil and gas investments.

is crucial for anyone considering entering this sector. Oil and gas investments can be highly lucrative but also come with significant risks. By familiarizing oneself with the fundamentals, such as supply and demand dynamics, extraction methods, and market trends, investors can make more informed decisions. Additionally, staying updated on global geopolitical events and energy policies is essential as they can greatly impact the industry. With the right knowledge and careful analysis, individuals can potentially capitalize on the opportunities presented by oil and gas investing.